Interested in starting an ATM business Learn the ropes with our simple guide we’ll walk you through the steps to get your venture up and running smoothly. Discover the ins and outs of this lucrative opportunity today.

Looking to start an ATM business lets dive in! Learn the ropes of launching your own ATM venture. Explore the steps needed to kicks tart your ATM business journey. Discover the secrets to success in the ATM industry. Ready to embark on this profitable venture let’s get started

Starting an ATM business is simple. First, research regulations and requirements in your area. Then, secure funding for machine purchases and operational costs. Next, find profitable locations with high foot traffic. Install and maintain your ATMs, ensuring they’re reliable and accessible. Finally, market your services to businesses and customers to grow your business.

Understanding ATM Business Basics

Understanding ATM business basics is crucial for success. Essentially, an ATM business involves owning and operating automated teller machines that dispense cash to customers. As an ATM operator, you earn revenue through transaction fees charged to users. Additionally, partnerships with financial institutions may offer surcharge fees, adding to your income stream.

To start an ATM business, you’ll need to invest in ATM machines and secure locations for installation. Typically, successful ATM locations include high-traffic areas like convenience stores, malls, and gas stations. Understanding the financial aspects, including initial investment, ongoing maintenance costs, and potential revenue streams, is crucial for making informed business decisions.

Moreover, staying updated on industry regulations, such as compliance with banking laws and ATM network regulations, is crucial. Building strong relationships with banking partners and understanding technological advancements in ATM technology will also contribute to the success of your ATM business.

Read this Blog: WHY IS FORESIGHT NOT GETTING TRACITON WITH BUSINESS

Researching Regulations and Requirements

Researching regulations and requirements is crucial before diving into the ATM business. Start by examining local and national laws governing ATM operations. Look into licensing requirements, zoning laws, and any necessary permits needed to operate ATMs in your area. Additionally, familiarize yourself with industry standards and best practices to ensure compliance and smooth operations.

Once you understand the legal framework, delve into financial regulations surrounding ATM transactions. Learn about compliance requirements such as Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations.

Understand the responsibilities associated with handling cash and maintaining accurate transaction records. By thoroughly researching these regulations, you can avoid legal issues and operate your ATM business with confidence.

Finally, consider consulting legal professionals or industry experts to ensure you have a comprehensive understanding of all regulations and requirements. They can provide valuable insights and guidance to navigate the complex regulatory landscape effectively. Remember, compliance is essential for the success and longevity of your ATM business, so invest time and effort in researching and understanding all relevant regulations and requirements.

Securing Funding and Financial Planning

Securing funding is crucial for launching an ATM business. Begin by assessing the costs involved, including machine purchases, installation, and operational expenses. Research various funding options, such as small business loans, investors, or personal savings.

Financial planning plays a vital role in the success of your ATM venture. Create a detailed budget outlining all expenses and projected revenue streams. Consider factors like machine maintenance, cash replenishment, and marketing costs. With a solid financial plan in place, you’ll be better equipped to manage your resources and ensure the profitability of your ATM business.

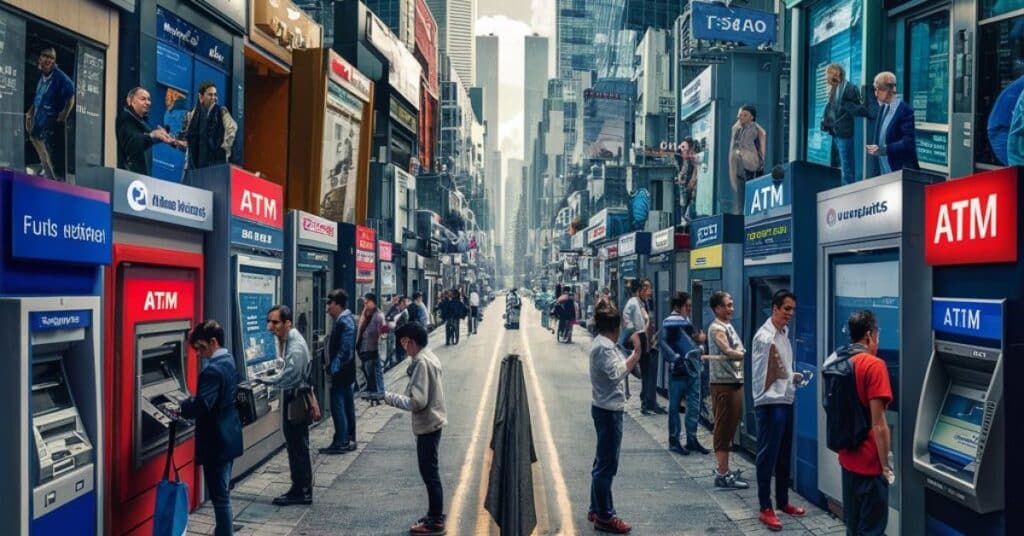

Locating Profitable ATM Sites

Locating profitable ATM sites is crucial for the success of your business. Start by identifying high-traffic areas such as shopping centers, malls, and busy street corners. These locations typically have a steady stream of potential customers needing access to cash. Additionally, consider places where there are limited ATM options nearby, increasing the demand for your services.

Once you’ve identified potential sites, conduct thorough research to assess their viability. Look into foot traffic patterns, nearby businesses, and demographics to gauge the potential for ATM usage. Seek out partnerships with local businesses or property owners to secure prime locations for your machines. Remember, the more convenient and accessible your ATM locations are, the higher the likelihood of generating profits for your business.

Regularly evaluate and adjust your ATM placements based on performance metrics such as transaction volume and revenue. Stay informed about changes in local regulations or shifts in consumer behavior that may impact site profitability. By strategically locating your ATMs in areas with high demand and optimizing their placement over time, you can maximize the profitability of your ATM business.

Installing and Maintaining ATM Machines

Installing and maintaining ATM machines is crucial for a successful ATM business. Firstly, choose optimal locations with high foot traffic and secure agreements with property owners. Then, coordinate with technicians for professional installation to ensure functionality and security. Regular maintenance checks are essential to prevent downtime and address any issues promptly.

Maintaining ATM machines involves routine servicing and replenishing cash supplies. Schedule regular inspections to ensure machines are in working order and restock cash as needed to avoid inconvenience to customers. Additionally, stay updated on security protocols and software updates to safeguard against potential threats and ensure smooth operation of your ATM fleet.

Marketing Strategies for ATM Services

Marketing your ATM services effectively can help maximize your business’s success. Firstly, identify your target market, such as retail businesses, gas stations, or event venues. Then, highlight the benefits of having an ATM on-site, like increased foot traffic and customer convenience.

Utilize various channels for promotion, including social media, local advertising, and partnerships with businesses. Additionally, offer incentives to businesses, such as revenue-sharing agreements or free installation, to encourage adoption of your ATM services.

Moreover, focus on building relationships with local businesses and communities. Attend networking events and establish partnerships with local organizations to increase awareness of your ATM services. Provide excellent customer service and ensure your ATMs are always operational and stocked with cash to maintain trust and reliability.

Lastly, monitor and analyze the performance of your marketing efforts regularly. Track metrics such as ATM usage, revenue generated, and customer feedback to refine your strategies and adapt to changing market demands. By continually optimizing your marketing approach, you can attract more clients and grow your ATM business successfully.

Growing and Scaling Your ATM Business

Expanding your ATM business requires careful planning. Begin by analyzing your current performance and identifying areas for growth. Consider adding more machines in high-traffic locations to increase revenue. Additionally, explore partnerships with businesses to place ATMs in their establishments, further expanding your network.

Scaling your ATM business involves strategic decision-making. Continuously monitor market trends and adapt your services accordingly. Invest in technology upgrades to enhance user experience and security. Moreover, prioritize customer satisfaction to build loyalty and attract new clients. with effective growth strategies and a focus on innovation, your ATM business can thrive in the competitive market. Stay agile, stay customer-centric, and keep seeking opportunities to expand your reach and impact.

Frequently Asked Questions

What are the initial steps to start an ATM business?

Begin by researching regulations, securing funding, and finding profitable locations for your machines.

How can I ensure the success of my ATM business?

Focus on selecting high-traffic locations, maintaining reliable machines, and providing excellent customer service.

What are the financial considerations when starting an ATM business?

You’ll need to budget for machine purchases, installation costs, ongoing maintenance, and potential cash reserves for transactions.

How do I attract businesses to host my ATMs?

Offer competitive terms, demonstrate the benefits of having an ATM on-site, and provide reliable service to build trust.

What marketing strategies can I use to promote my ATM services?

Utilize digital marketing, network with local businesses, and offer incentives for customers to use your ATMs to increase visibility and usage.

Conclusion

In conclusion, starting an ATM business presents a lucrative opportunity for entrepreneurs willing to navigate the complexities of the industry. By meticulously researching regulations, securing adequate funding, and identifying prime locations, aspiring ATM owners can lay a solid foundation for success. However, the journey doesn’t end there. To thrive in this competitive field, continuous attention to detail and customer satisfaction is paramount.

Providing reliable machines, maintaining excellent service standards, and strategically marketing your services are key elements in ensuring the long-term viability of your business. Furthermore, staying abreast of technological advancements and market trends will enable you to adapt and innovate, keeping your ATM business ahead of the curve.

With careful planning, dedication, and a customer-centric approach, entrepreneurs can embark on a rewarding venture in the world of ATM ownership, tapping into a steady stream of revenue while providing essential financial services to communities.

Alexander K. Barry, an experienced author with five years in business, explores the intricate dynamics of entrepreneurship, management, finance, and innovation through insightful narratives and practical wisdom.